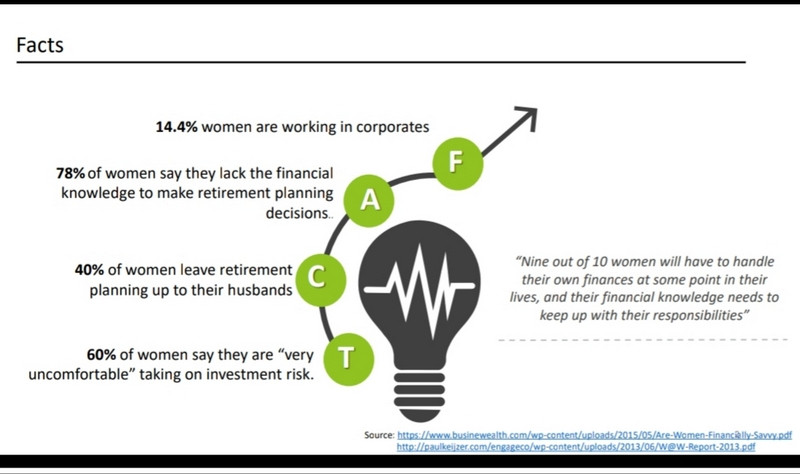

There is an immense need for Women to become Financially Savvy and learn the ropes of independently investing. Not only the short term but also a focused approach to mid to long term investment!

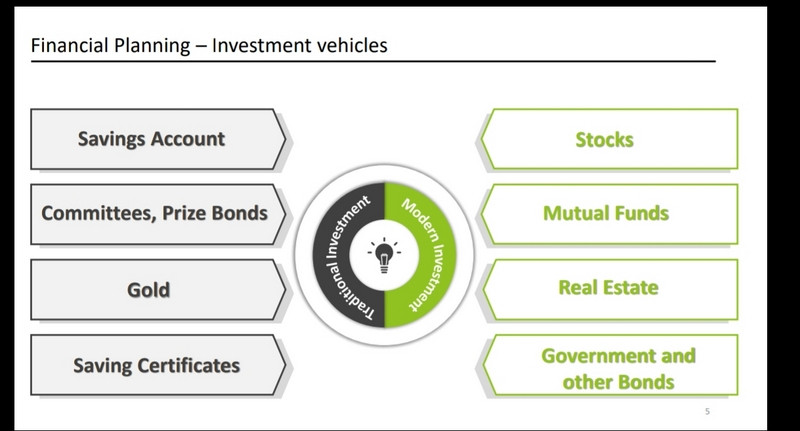

When it comes to Financial Planning, there are 3 major steps in the process – budgeting, saving and investing. Women have a hands-on experience of budgeting and saving but when it comes to investing they have been on the side-lines. They have opted only for the traditional modes of investing.

Long-term Investing

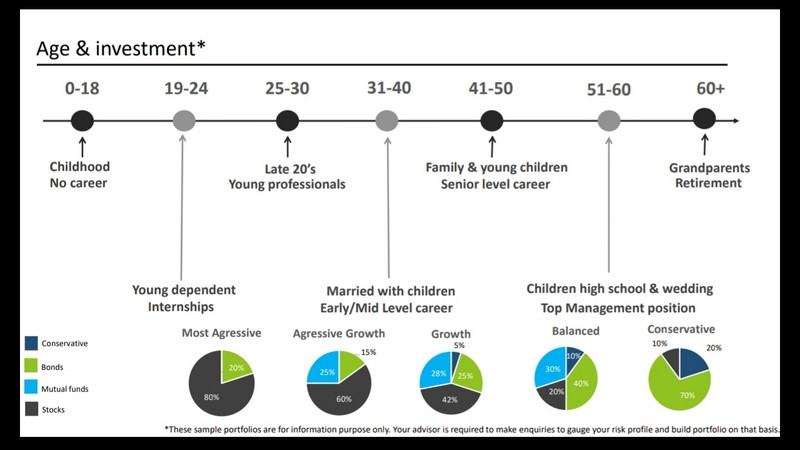

It is time for women to think of long term investing, retirement planning and study and opt for the modern investment avenues. Women are scared of making a loss as they have a strong sense of responsibility and do not opt for taking risks. Not even calculated risk. Women generally are very hard on themselves when they incur a loss of any sort.

Men also incur losses but they realise it is part and parcel of the investment process. So women must also learn to take calculated risk and opt for the modern investment avenues which in turn will bring a multiplier effect to their traditional simple profit yielding investing avenues.

The Basics of Investing

There is a strong need for women to understand the financial planning basics – the risk and reward continuum. As well as build diverse portfolios with all types of asset classes. Whether it is Stocks, savings certificates, mutual funds, gold, real estate or insurance policies!

Some investment vehicles are short term while others are medium and long term. And it is imperative to understand that the long term investments yield results in 10 to 20 years because the compounding effect kicks in, in the longer duration only.

Investing Myths

Women today retire with two-thirds less in assets than men, partly because of their aversion to investing.

Many barriers prohibit women from investing, including risk intolerance and lack of confidence. These common myths about investing make women reluctant to try:

Myth: I need to have a lot of money before I can start investing.

Fact: Even saving a small amount is better than nothing, especially for the long term.

Myth: Investing is too risky.

Fact: You can choose your asset allocation based on your risk tolerance. In fact, not investing is risky, too.

Myth: I don’t know enough about the market to start investing.

Fact: You don’t need to know much to participate in a n equity mutual fund. Sometimes knowing too much can backfire, and attempts at “timing the market” often fail.

Myth: I don’t need to start investing until I’m older.

Fact: Investing early increases the magic of compound interest

If women can overcome these myths and gain confidence in their investing abilities, they might actually be better equipped for investing than men.

Investment Vehicles

How to Become Financially Savvy:

Take charge of your budget: A budget is a detailed summary of probable income and expenses for a given period.

Build a contingency fund: A contingency fund helps create a reserve of money that can be easily accessed in case of any sudden unforeseen expenses

Save for retirement –Invest it: The earlier you start saving, the easier it is to build up a nest egg that is big enough to let you continue to live a relaxed lifestyle post retirement.

Invest wisely – diversify: One should choose their investment product option after consulting a financial expert by defining short term and long term goal requirements

There is no easy way: Small investments over time can make money work for you. Do not fall for schemes which offer high returns in a very short time.

Avoid debt: Debt drains away your income in the form of EMIs that come knocking every month!

Till date it is our women folk who have not only provided the emergency funding requirement to the family. They have also provided seed /initial capital for many Entrepreneurial projects and SME’s that we see around us.

That in itself is a testament to the fact that women are wonderful savers. Happy learning!